Engaging in financial markets, especially with leveraged instruments like Contracts for Difference (CFDs), inherently encompasses risks that must be fully understood and accepted by traders before participation. This document provides a comprehensive exploration of the risks associated with CFD trading to help traders make informed decisions and manage their risk exposure effectively.

Comprehending Trading Risks

CFD trading exposes traders to various risks, particularly with leveraged financial instruments. Understanding these risks and their potential effects on your financial health is crucial.

Risks Associated with Leverage

- Leverage: A defining feature of CFD trading, leverage allows traders to control large positions with relatively small amounts of initial capital. While this can amplify potential returns, it also significantly increases potential losses, which can exceed the initial investment. Effective risk management strategies are essential to mitigate these substantial risks.

Counterparty Risks

- OTC Transactions: CFD transactions occur over-the-counter (OTC) with the broker acting as the counterparty. This setup means positions are not transferable to other entities, exposing you to the risk of the broker’s credit failure. Insolvency or failure of the broker to meet financial obligations could lead to the unexpected liquidation of your positions and potential losses.

Market-Related Risks

- Volatility: Market conditions can change rapidly, increasing both profit potential and risk of loss. Managing these volatile conditions is critical as they can lead to significant financial impacts quickly.

- Currency Risk: Trading CFDs in a currency different from your account’s base currency introduces foreign exchange risk. Exchange rate fluctuations can affect the actual profits or losses realized, independent of the underlying asset’s performance.

- Liquidity Risk: The risk of liquidity arises when underlying assets become difficult to trade or lack adequate market depth, potentially leading to wider bid-ask spreads and more costly transactions that could result in losses.

Technical and Operational Risks

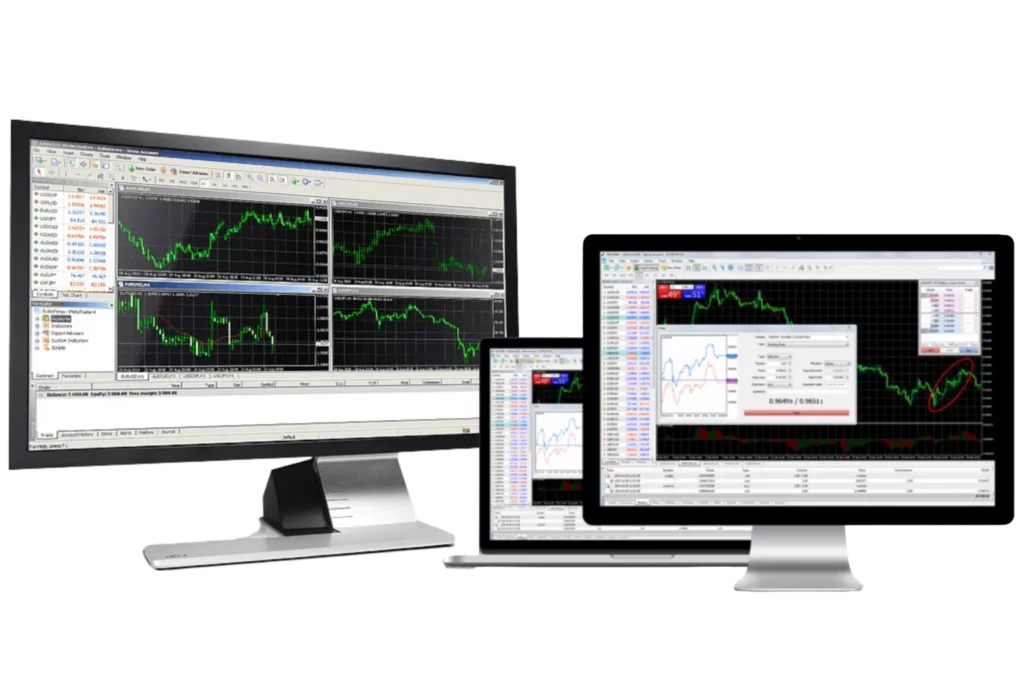

- Trading Platforms: The stability and functionality of the broker’s trading platforms are vital. Technical disruptions or security breaches can impact order execution and trading effectiveness. Using reliable technologies and maintaining a stable internet connection are important to mitigate these risks.

- Communication Risks: Keeping communication channels with your broker up-to-date is crucial. Outdated contact information or failed communication channels can lead to missed updates, impacting your trading decisions.

- Force Majeure Events: Extreme events such as natural disasters or geopolitical unrest can disrupt trading operations. Losses resulting from such events may not be the broker’s responsibility.

Pricing and Execution Risks

- Slippage: Occurs when the actual execution price of a trade differs from the expected price, often during high volatility or low liquidity. This can reduce profits or increase losses unexpectedly.

- Abnormal Market Conditions: During unusual market conditions, executing or closing positions may become challenging or impossible. This can result in stop-loss orders not being executed at anticipated prices, amplifying losses beyond expectations.

Legal and Regulatory Risks

Engaging in CFD trading requires adherence to legal and regulatory frameworks that vary by jurisdiction. Compliance with these regulations is mandatory.

Additional Considerations for Traders

- Margin Requirements: Monitoring your account to ensure sufficient funds for margin requirements is crucial. Failure to meet these requirements can lead to forced position closures and significant losses.

- Ownership: CFD trading does not grant ownership of the underlying assets. These instruments derive their value from price movements of the assets, and traders do not acquire any material rights to them.

- Tax Considerations: The tax implications of CFD trading vary by region. Traders should seek independent tax advice to ensure proper compliance and planning.

- Security Concerns: The online nature of CFD trading can expose traders to enhanced security risks, including fraud or cyber threats. Implementing robust cybersecurity measures is essential to protect personal and financial information.

Conclusion

CFD trading offers the potential for significant financial gains but carries substantial risks. This disclosure outlines key risks, including leverage, counterparty, market, technical, pricing, execution, and regulatory risks. Prospective traders should assess their financial situation, investment objectives, experience level, and risk tolerance before engaging in CFD trading. Consulting with financial, legal, and tax professionals is recommended to fully understand these risks. Adhering to responsible trading practices and staying informed about market conditions and regulatory updates are essential for navigating the complexities of CFD trading. Remember, only invest funds you can afford to lose.