- 1. Eligibility and Account Registration

- 2. Deposits and Withdrawals

- 3. Trading Policies

- 4. Fees and Charges

- 5. Risks and Liabilities

- 6. Use of Platform and Tools

- 7. Privacy and Data Protection

- 8. Conflict Resolution and Complaints Handling

- 9. Amendments and Termination

- 10. Governing Law

- 11. Miscellaneous Provisions

Welcome to Exness! Please read these Terms and Conditions carefully before using our services. By registering an account and using our platforms, you agree to be legally bound by these terms.

1. Eligibility and Account Registration

Eligibility Criteria:

- Age Requirement: You must be at least 18 years old or of legal age in your jurisdiction.

- Legal Compliance: Ensure that trading with Exness does not violate any local laws or regulations, including those related to taxation.

Account Registration Process:

- Application: Complete the online registration form with your personal details.

- Documentation: Provide verification documents such as a government-issued ID and a utility bill or bank statement.

- Verification: Exness will verify your information to prevent fraud.

- Account Types: Choose an account type that suits your trading needs.

- Account Activation: After verification, you will receive an email with account details. You can then fund your account and start trading.

2. Deposits and Withdrawals

Depositing Funds:

- Methods: Bank transfers, credit/debit cards, and e-wallets like Skrill and Neteller. Local payment methods may also be available.

- Minimum Deposit: Varies by account type and method; details are available on the Exness website.

- Processing Time: Instant for most methods; bank transfers may take longer.

- Deposit Fees: Exness does not charge fees for deposits, but third-party fees may apply.

Withdrawing Funds:

- Withdrawal Methods: Must match deposit methods for security reasons.

- Minimum and Maximum Withdrawal: Varies by method and account type; details are available in your personal area.

- Processing Time: Generally quick; bank transfers may take longer.

- Withdrawal Fees: Typically, there are no fees from Exness, but third-party fees may apply.

Additional Security Checks:

- Verification Process: Exness may re-verify identity for large withdrawals or new payment methods.

- Regulatory Compliance: Transactions comply with financial regulations to prevent fraud.

Guidelines for Smooth Transactions:

- Keep your documents updated.

- Be aware of transaction limits and processing times.

- Contact customer support if issues arise.

3. Trading Policies

Types of Trading Instruments:

- Forex: Major, minor, and exotic currency pairs.

- Metals: Gold, silver, and other precious metals.

- Cryptocurrencies: Bitcoin, Ethereum, and more.

- Indices, Stocks, and Commodities: Global indices, stocks, and commodities.

Trading Hours:

- Forex: Available 24/5 (Monday 00:05 to Friday 23:55 server time).

- Cryptocurrencies: 24/7.

- Other Instruments: Varies by market and public holidays.

Order Execution:

- Market Execution: At the best available price; slippage may occur.

- Instant Execution: Trades at the displayed price; requotes may be offered if prices change.

Leverage and Margin:

- Leverage: Varies by account type and instrument.

- Margin Requirements: Depends on leverage, account type, and trade size; can change with market conditions.

Risk Management Tools:

- Stop Loss and Take Profit Orders: Manage risks and secure profits.

- Negative Balance Protection: Prevents losses exceeding deposits.

Policies on Scalping and Hedging:

- Scalping: Permitted with specific execution terms.

- Hedging: Allowed with open positions in opposite directions.

Rollovers and Swaps:

- Overnight Positions: May incur or receive swap charges based on interest rate differentials.

- Islamic Accounts: Swap-free options available.

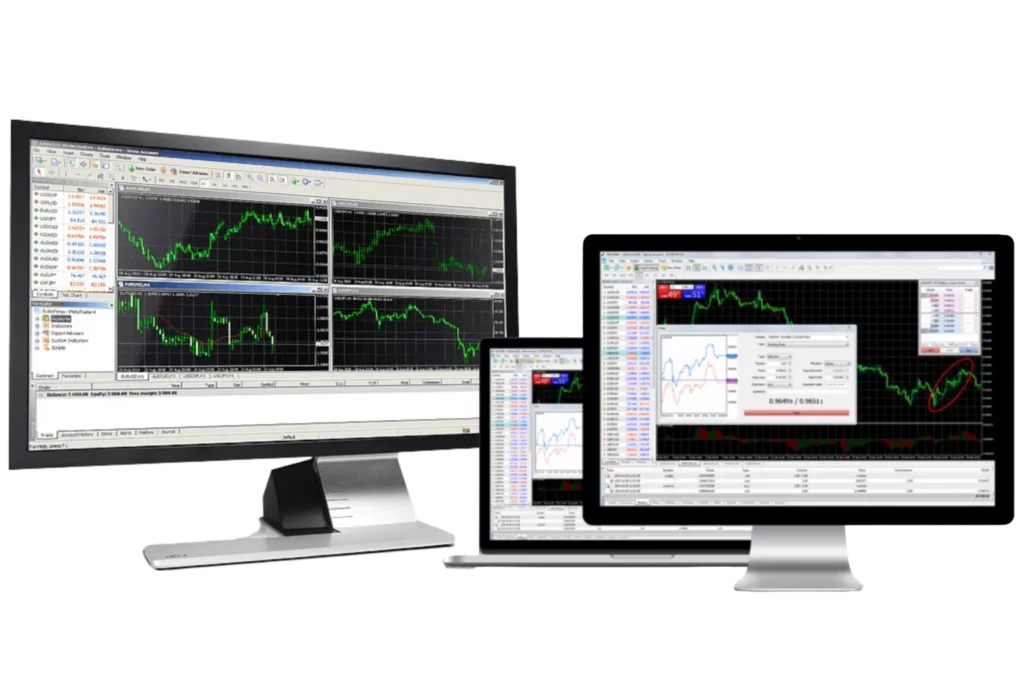

Use of Trading Platforms:

- Platforms: MetaTrader 4 and MetaTrader 5, among others.

- Usage Policies: Ensure ethical use of trading technology.

Adherence to Regulations:

- Compliance: Exness adheres to international regulatory standards.

4. Fees and Charges

Trading Fees:

- Spreads: The difference between bid and ask prices; competitive spreads starting from 0.0 pips.

- Commissions: Applicable to some account types (e.g., Raw Spread and Zero accounts), fixed per lot.

Non-Trading Fees:

- Overnight Fees (Swaps): Charges for holding positions overnight.

For more details, please refer to the Exness website or contact our support team.

Note: These Terms and Conditions are subject to change. Regularly review them to stay updated on any modifications.

5. Risks and Liabilities

At Exness, we prioritize transparency and informed decision-making to help our clients understand the inherent risks associated with trading. This section provides essential insights into trading risks, Exness’s liabilities, and the responsibilities of traders, helping you manage your trading activities more effectively.

Understanding Trading Risks

- Market Risk: Investments can experience significant fluctuations due to various factors, including economic changes, political events, and natural disasters. It’s important to recognize that losses can exceed deposits, especially when using leverage.

- Leverage Risk: Leverage can amplify both potential gains and losses. Using leverage requires careful consideration of its impact on your trading positions.

- Liquidity Risk: During volatile market conditions, certain financial instruments may have low liquidity, which can hinder your ability to execute trades at desired prices. In extreme cases, trades may not be executable at all.

- Credit Risk: This risk arises from the potential failure of a counterparty to meet financial obligations. Exness mitigates this risk by partnering with reputable financial institutions and monitoring counterparties.

- Operational Risk: Includes risks related to technological failures, system outages, or human errors. While Exness employs advanced technology to minimize these risks, they cannot be entirely eliminated.

Exness’s Liabilities

- Limitation of Liability: Exness is not liable for any losses or damages arising from the use or reliance on our trading platforms, tools, or their unavailability, unless directly caused by our negligence.

- Indemnification: By trading with Exness, you agree to indemnify and hold us harmless from any liabilities, losses, damages, costs, and expenses, including legal fees, arising from your failure to comply with these Terms and Conditions or your trading activities.

Responsibility of Traders

- Assessing Suitability: You must ensure that trading is appropriate for you based on your circumstances, financial resources, and understanding of the associated risks. Trading is not suitable for everyone and involves significant risk.

- Seeking Advice: If you are unsure about the risks of trading, it is advisable to seek independent financial advice.

Insurance and Compensation

- Compensation Schemes: Exness participates in compensation schemes like the Financial Commission’s Compensation Fund, which offers additional security for clients’ funds in the event of broker insolvency.

Risk Management Tools

Exness provides various tools to help manage trading risks, including:

- Stop-Loss Orders: To limit potential losses by automatically closing trades at predefined levels.

- Negative Balance Protection: To prevent losses exceeding your account balance.

- Real-Time Alerts: To notify you of significant market movements or account changes.

Legal Compliance and Regulatory Framework

Exness adheres to international regulatory standards and local legal requirements to ensure safe, fair, and transparent trading conditions. We are committed to high ethical standards and compliance with relevant laws and regulations, providing a secure trading environment for all clients.

6. Use of Platform and Tools

Exness offers advanced trading platforms and a comprehensive suite of tools designed to enhance your trading experience. This section outlines the terms of use for our platforms and tools, ensuring they are utilized effectively and responsibly.

Trading Platforms

- MetaTrader 4 (MT4) and MetaTrader 5 (MT5): Renowned for their robust functionality, including technical analysis, automated trading through Expert Advisors (EAs), and customizable trading environments. Users must adhere to software usage terms and avoid manipulation or unethical use of trading technology.

- Exness Terminal: Our proprietary platform features an intuitive interface with advanced trading features and real-time analytics. It is regularly updated to improve functionality and security.

- Mobile Apps: Available for Android and iOS, our mobile apps allow for trading on the go with comprehensive account management capabilities. Users should download apps from official sources to mitigate security risks.

Analytical Tools

Exness provides a range of analytical tools, including:

- Charting Tools: For detailed technical analysis.

- Economic Calendars: To track important economic events.

- Financial News Updates: To stay informed of market-moving news.

- Market Summaries: For a concise overview of market conditions.

These tools are intended for personal use only; unauthorized dissemination or commercial use is strictly prohibited.

Automated Trading

Automated trading scripts (EAs) on MT4 and MT5 facilitate algorithmic trading. Users can develop or use EAs, but must do so responsibly and in accordance with our trading policies to maintain market integrity.

Intellectual Property

All content, technology, and software on our platforms are owned by Exness or our licensors and are protected by copyright laws. You are prohibited from copying, modifying, distributing, selling, or leasing any part of our services or software, or attempting to reverse engineer or extract the source code, except as permitted by law.

Security

Clients must maintain the security of their account information, including passwords. Exness employs stringent security measures to protect client data and financial transactions. Clients should also secure their devices against malware.

Data Accuracy

While Exness strives to provide accurate and up-to-date information, occasional inaccuracies may occur. Clients should independently verify critical information, particularly before making significant trading decisions.

Usage Limitations and Fair Use

To ensure platform stability and performance, Exness may impose usage limitations in cases of excessive use or service abuse. Clients must use platforms and tools ethically and avoid activities that could manipulate market conditions or unfairly disadvantage other traders.

Support and Updates

Exness provides comprehensive support via live chat, email, and phone. Regular updates are made to enhance functionality, introduce new features, and improve the security of our platforms and tools.

7. Privacy and Data Protection

At Exness, protecting the privacy and security of your personal information is paramount. This section details our policies and practices concerning the collection, use, and protection of your data.

Data Collection

- Personal Information: Collected during account registration, including your name, address, email, and financial details, necessary for account setup, verification, and regulatory compliance.

- Transactional Data: Documented to ensure transparency, facilitate audits, and comply with financial regulations.

- Usage Data: Includes login information, platform preferences, and trading patterns, used to enhance services and provide personalized support.

Use of Personal Data

- Account Management: Used for managing your account, providing support, processing transactions, and addressing inquiries.

- Compliance and Security: Utilized to meet legal and regulatory requirements, including anti-money laundering laws, and to ensure account security.

- Communication: Contact information may be used to send updates about your account, security information, and product news. Communication preferences can be managed through your account settings.

Data Protection Measures

- Encryption: Advanced encryption technologies protect data transmitted between your devices and our servers.

- Access Controls: Access to personal data is limited to authorized personnel bound by confidentiality obligations.

- Regular Audits: Conducted to ensure our data protection practices meet high standards.

Sharing of Personal Data

- Regulatory Compliance: We may share information with regulatory authorities as required by law to fulfill legal obligations.

- Service Providers: We share information with trusted third-party service providers who assist us in operating our platforms, conducting business, or serving users. These parties are contractually obligated to maintain data confidentiality.

8. Conflict Resolution and Complaints Handling

Exness is dedicated to providing high-quality service and addressing any disputes or concerns that may arise. This section outlines the process for resolving complaints and conflicts effectively and fairly.

Steps for Filing a Complaint

- Contact Customer Support:

- Your initial point of contact should be our 24/7 customer support team. Many issues can be resolved promptly at this stage.

- Formal Complaint Submission:

- If your issue remains unresolved, you can submit a formal complaint. Include a detailed description of the issue, relevant dates, times, and supporting documents. Send complaints to the dedicated complaints email address provided on our website and client portal.

- Complaint Acknowledgment:

- We will acknowledge receipt of your complaint within one business day and provide an estimated resolution time, typically within 10 business days.

- Investigation Process:

- The compliance department will thoroughly investigate your complaint. We may request additional information to ensure a fair evaluation.

- Resolution Proposal:

- After investigation, we will provide a detailed response outlining our findings, reasoning, and any actions to resolve the complaint.

- Escalation:

- If dissatisfied with the outcome, you may escalate the issue. We will provide details on the escalation process and contact information for senior management or external dispute resolution bodies.

External Dispute Resolution

If internal resolution efforts are unsatisfactory, clients can access independent external dispute resolution (EDR) services. Exness is a member of the Financial Commission, offering a neutral third party for dispute review and adjudication.

Commitment to Fairness

Exness takes all complaints seriously and strives to resolve them fairly, maintaining trust and long-term client relationships.

Continuous Improvement

We view the complaints process as a chance for improvement. Client feedback is regularly reviewed to enhance our services and prevent future issues.

Contact Information

For detailed contact information for customer support, formal complaints, and external dispute resolution, visit our website and client portal.

9. Amendments and Termination

Exness is committed to maintaining a reliable trading environment, but changes to terms, services, or account terminations may be necessary. This section outlines our policies regarding amendments and account termination.

Amendments to Terms and Conditions

- Reasons for Amendments:

- Regulatory Changes: Updates may be required to comply with new regulatory standards.

- Technological Advancements: Changes to improve security or functionality.

- Market Conditions: Adjustments due to shifts in market dynamics.

- Operational Changes: Modifications in procedures affecting service terms.

- Notification of Amendments:

- Clients will be notified of significant changes through email, platform notifications, or website announcements. Typically, a 30-day notice period is provided unless urgent changes are needed.

- Acceptance of Amendments:

- Continued use of our services after changes will be considered acceptance of the new terms. Clients who disagree may close their accounts following the outlined procedures.

Termination of Services

- Client-Initiated Termination:

- Clients can terminate their accounts by contacting customer support. Ensure all positions are closed and balances withdrawn before requesting termination. We will assist with the closure process and settle financial obligations.

- Exness-Initiated Termination:

- Exness reserves the right to terminate accounts for reasons such as:

- Breach of Terms: Non-compliance with terms and conditions.

- Fraudulent Activities: Involvement in illegal activities.

- Risk to Operations: Actions threatening platform integrity or other clients.

- Notice will be provided unless immediate termination is warranted by security concerns or legal requirements.

- Exness reserves the right to terminate accounts for reasons such as:

Effect of Termination

Upon termination, access to services will be revoked, and remaining balances will be returned, subject to withdrawal fees and outstanding charges.

Dispute Resolution Post-Termination

For disputes related to the termination process or final settlements, contact customer support or use our formal dispute resolution process.

Record Retention

Exness will retain transaction records and personal data post-termination as required by law for regulatory and audit purposes.

10. Governing Law

Exness operates under specific legal frameworks to ensure compliance and fair practices. This section details the governing law applicable to agreements and services.

Applicable Jurisdiction

- Primary Regulation:

- The governing law depends on the Exness entity you are registered with:

- Exness (Cy) Ltd: Regulated by the Cyprus Securities and Exchange Commission (CySEC), operating under Cypriot law.

- Exness (UK) Ltd: Regulated by the Financial Conduct Authority (FCA) in the UK, operating under English law.

- Other entities are regulated by corresponding authorities in jurisdictions like South Africa and Seychelles.

- The governing law depends on the Exness entity you are registered with:

Role of Governing Law

- Contractual Relations:

- Defines the legal framework for contractual obligations, including terms of service and dispute resolution.

- Dispute Resolution:

- Provides the basis for legal proceedings in case of disputes, outlining rights, obligations, and resolution procedures.

- Regulatory Compliance:

- Ensures adherence to financial regulations specific to each jurisdiction, protecting clients and the company.

Legal Compliance

Exness adheres to laws and regulations, including anti-money laundering (AML) procedures, counter-terrorism financing (CTF) standards, and data protection regulations.

Implications for Clients

Clients should understand how governing law impacts their accounts and activities, especially if residing in a different jurisdiction from where Exness entities are registered. Legal advice may be needed for clarity on cross-border implications.

Changes in Governing Law

Exness will notify clients of any changes to governing laws affecting service terms or operational procedures and update legal documents accordingly.

Contact Information

For questions regarding governing law, clients can contact Exness Customer Support. Detailed contact information is available on our website.

11. Miscellaneous Provisions

In addition to the specific terms outlined in other sections, the following miscellaneous provisions apply to all Exness clients. These provisions ensure smooth interactions and compliance with regulatory standards.

Force Majeure

- Definition: Force majeure events are those beyond Exness’s reasonable control, including but not limited to natural disasters, war, riots, civil unrest, actions by authorities, fires, floods, accidents, strikes, or shortages in transportation, fuel, energy, labor, or materials.

- Impact: Exness is not liable for any failure to perform its obligations under these terms and conditions if such failure results from a force majeure event.

Assignment

- Client Restrictions: Clients may not assign or transfer any of their rights or obligations under these terms and conditions without Exness’s prior written consent.

- Exness Rights: Exness may assign its rights and obligations to another entity at its discretion, provided this does not adversely affect the rights of clients.

Severability

- Invalid Provisions: If any provision is found to be invalid, illegal, or unenforceable, the remaining provisions will continue in full force, preserving the essence of the agreement.

- Replacement: An invalid provision will be replaced with one that closely achieves the original purpose.

Waiver

- Non-Enforcement: Failure by Exness to enforce any provision or exercise any option does not constitute a waiver of such provisions or affect the validity of these terms.

Amendments to Miscellaneous Provisions

- Right to Amend: Exness reserves the right to amend these miscellaneous provisions at any time. Amendments take effect immediately upon being posted on our website or notified to clients through other means.

Headings

- Convenience Only: Headings are provided for convenience and do not affect the interpretation of the terms and conditions.

Governing Language

- Language Consistency: In case of inconsistencies between the English version and any other language version of these terms, the English version prevails.

Entire Agreement

- Complete Agreement: These terms and conditions constitute the entire agreement between the client and Exness concerning the use of our services, superseding all prior communications and proposals, whether electronic, oral, or written.

Legal and Regulatory Information

- Further Details: For more details on the legal and regulatory framework governing Exness operations, refer to specific sections of these terms and conditions or contact our support team for assistance.